Panama Paradise: Analysis of Tax Heaven by Country

Panama Paradise: Analysis of Tax Heaven by Country

The Panama Papers are an unprecedented leak of 11.5 million documents from the database of the world’s fourth-biggest offshore law firm, Mossack Fonseca. It presents financial and attorney-client information for more than 214,488 offshore entities. The documents contain personal financial information about wealthy individuals and public officials that had previously been kept private. While offshore business entities are legal (see Offshore Magic Circle), reporters found that some of the Mossack Fonseca shell corporations were used for illegal purposes, including fraud, tax evasion, and evading international sanctions according to ICIJ reporters, for example:

In Uruguay, 5 people have been arrested and charged with money-laundering through the Mossack Fonseca by setting up shell companies for a Mexican drug cartel. It has also been reported by Ouestaf, an ICIJ partner, that Karim Wade a Senegalese politician received payments from DP World. Karim and a friend of his were convicted of this.

In the leak, there were also present more than 140 international power players like former world leaders, politicians, celebrities, businessmen and other wealthy families and individuals. The dataset comprises data coming from over 200 countries.

Having an offshore company is actually legal, so whoever is reading this should not conclude that these power players are actually corrupt. In fact, what we discovered that having only this dataset, we are able only to do statistical analysis rather than discovering corruption which was our initial goal.

Research Questions

Questions?

Given the amount of information and the sensible topic, we can ask some interesting questions:

-

The story of panama: How and when it became a fiscal paradise? What are the most implicated countries ? Is there a common point between them?

-

How does the correlation between a country economic/sociopolitical conditions change? Can we find higher correlation between undeveloped country?

-

How did the economical situation of the fiscal paradise change over the years?

We focus primarly on the correlation between the number of entities mentioned in the documents belonging to a country and its economical/social condition based on different economical and financial indeces.

For the analysis we are not using the full dataset but a graph based version provided by the International Consortium of Investigative Journalists (ICIJ) which shared the panama papers dataset in 4 languages. It was first made of NET files (made of nodes and relationships between the nodes). To make the dataset accessible to everyone ICIJ converted the original dataset into several CSV files, one per type of node and one for all the relationships for each project. The data size is 352 Mb and may be downloaded in a zip file from the offshore leak database website dataset.

Analysis

Exploratory Analysis

Panama papers, as most of the offshore datasets that are found online, contains 5 types of roles:

- Entity: An Entity is an offshore company that has been created in a low-tax place.

- Officer: An Officer is somebody or something that has some roll in the offshore entity. Most of the times an officer is a person, though it can also be a company or a foundation.

- Intermediary: An Intermediary is usually serving as a middleman for somebody that wants to open an offshore company or to find an offshore service provider.

- Address: An Address which serves as the contact postal address of the offshore entity.

- Edges which represent the relationships between entities, officers, intermediaries, and addresses.

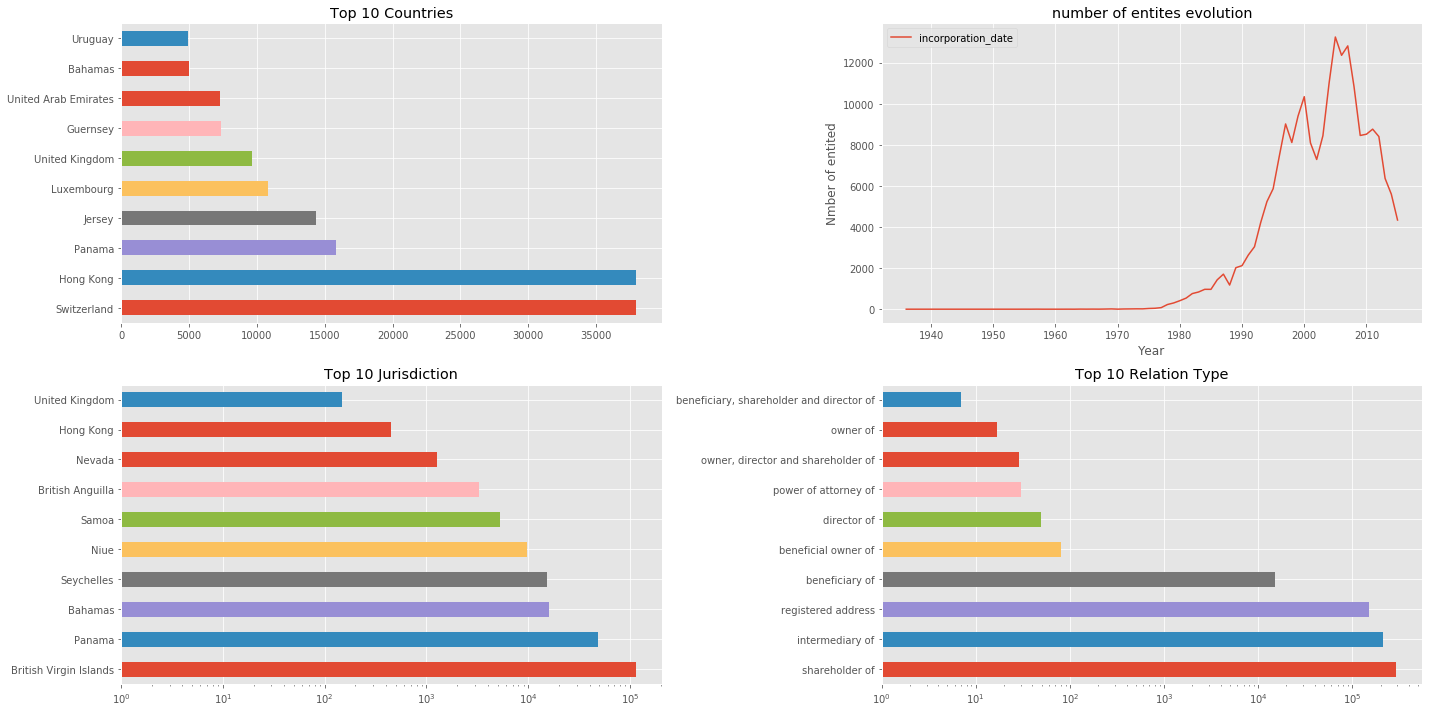

Next, we start by finding out some information about the countries involved, namely which are the countries most mentioned in the papers and which are the most used jurisdiction for the companies. In the following plot we visualize our findings.

We see that Switzerland and Hong Kong are the most involved countries per number of entities, which is expected given the importance of the swiss bank secrecy before the financial crisis. The amount of entities increases steadily from the 90s to 2010, where it starts to decrease most probably because of stricter measure against tax evasion by different jurisdiction, especially G20 countries.

Answering

Answering the question!

Now that we get a sense of how the dataset is composed, and which kind of relationship there are, we can tackle our main question: is there a correlation between number of countries involved and their economical/financial services?

We are going to use the following index:

- Gini index: it is a statistical measure of distribution used as a gauge of economic inequality, measuring income distribution or, less commonly, wealth distribution among a population. The coefficient ranges from 0% to 100%.

- Perceived Corruption index: It tries measure how corrupt country’s public sectors are seen to be.

- Service ecxports (BoP,US dollars): A brief overview of exporting services overseas. This information is taken from “A Basic Guide to Exporting” provided by the U.S. Commercial Service to assist U.S. companies in exporting.

- financial exports as a percentage of:

- human development index:

- tax on income percentage:

Correlation Analysis

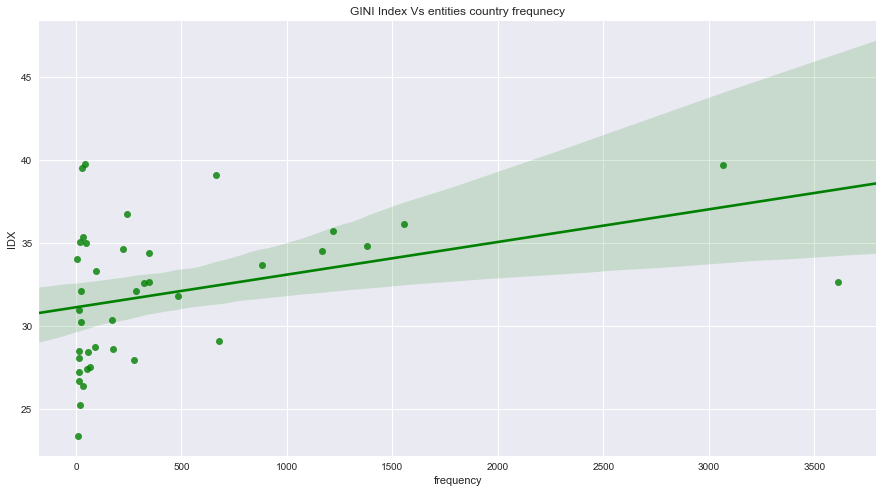

The Gini index and the entities origin country frequency has a correlation value equal to 0.37058975049658943 with a p-value of 0.018572682928927605. If this probability is lower than the conventional 5% ( 95% confidence interval for the correlation coefficient) the correlation coefficient is called statistically significant.

In other words the correlation between the Gini index and entities country frequency is indeed correct and significant. However, it is weakly correlated, because there were a lot of outliers that we removed and it confers only countries cited between 5 and 8000 times with a Gini index less than 40, in other words poor countries as seen in the figure below.

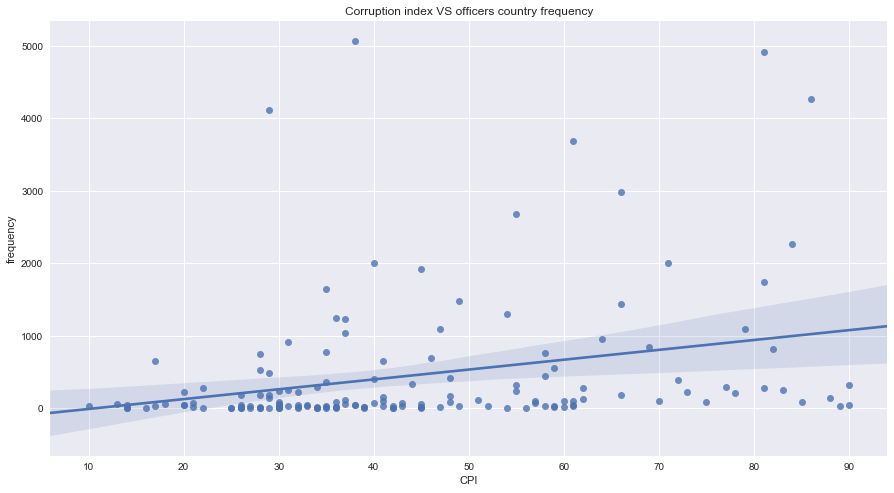

The second index is the perceived corruption index. In this case there is also a very low correlation between the officers country frequency and the corruption index of 0.2903529327551021 with p-value 0.000247455687383302.

This correlation is statically significant. However the majority of the countries are cited less than 200 times. This result makes sense, the more the country is perceived to be corrupted, the more it is cited. Corrupted countries have corrupted officers.

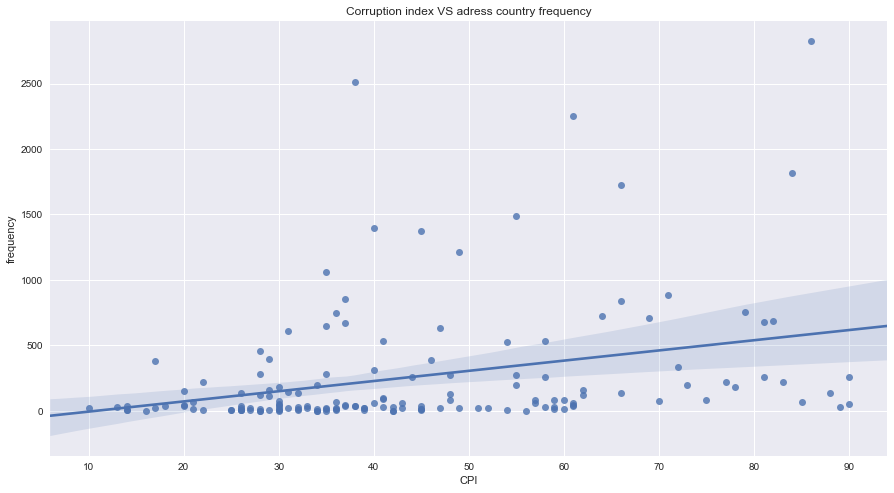

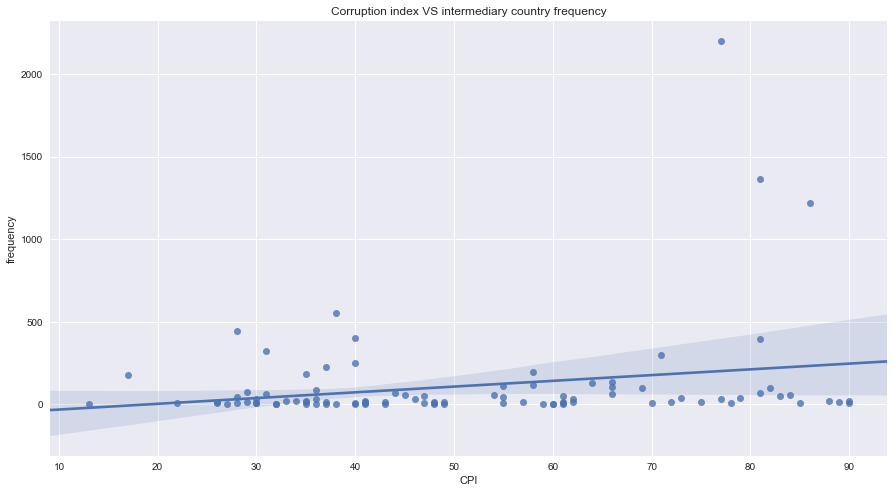

The perceived corruption index is also correlated with the Panama address with 0.31385266422046715 and p value 8.235035924362218e-05. The correlation is lower with the the intermediary with 0.22905312295895672 and p value 0.02637461882225528.

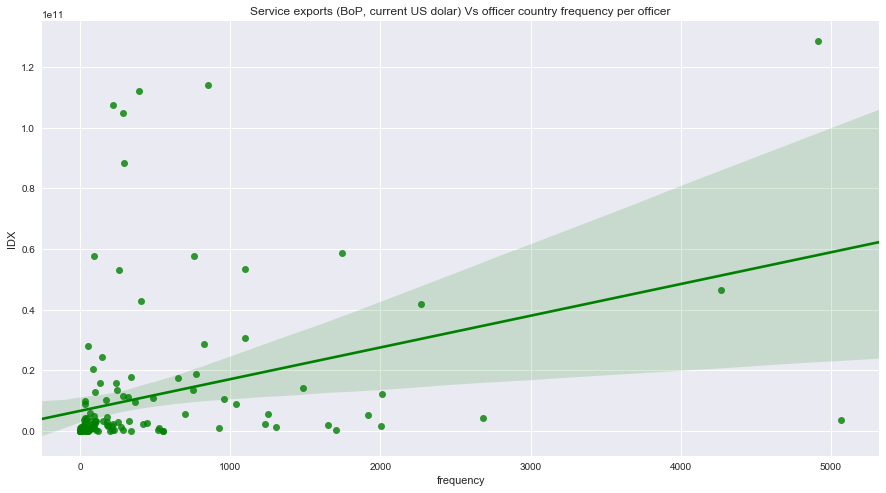

The third index is the service exports (BoP,US dollars). With this we want to show that service countries have more entities and officers cited. In fact service countries have more money laundry and have more money transactions with the offshore countries. In fact there is a low correlation between the service exports and the officers with a correlation value of 0.3544542144618415 and p-value 1.2191864422245798e-05.

Since in the service exports we are more interested in the financial services we checked with the fourth index is the insurance and financial services as percentage of service exports. As expected the correlation is higher in this case with the officer countries with 0.4102701171441421 and p-value 3.9620220677934937e-07.

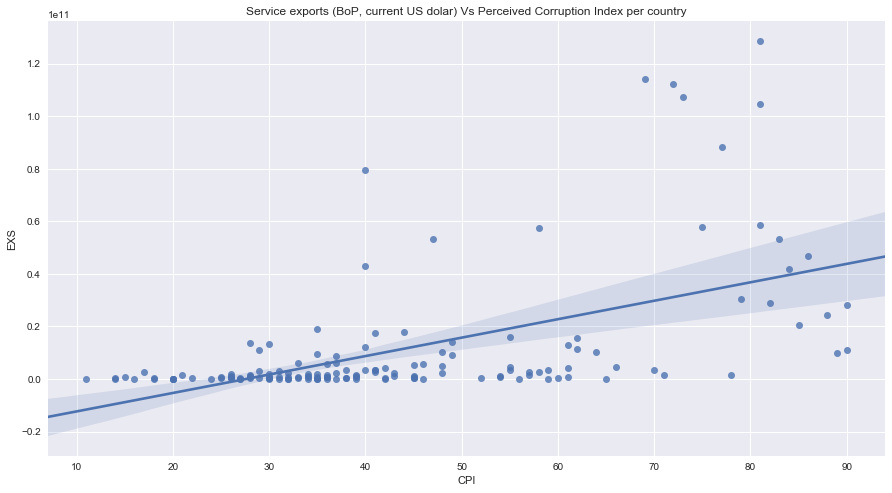

From the previous graph we saw that the origin countries are correlated with the corruption and the service exports. For this reason we plot the perceived corrution as a function of the service exports for each country and we find a correlation value of 0.5458846576026938 with p-value 7.216328423040093e-13. This may indicates that the service country are maybe more corrupted ones.

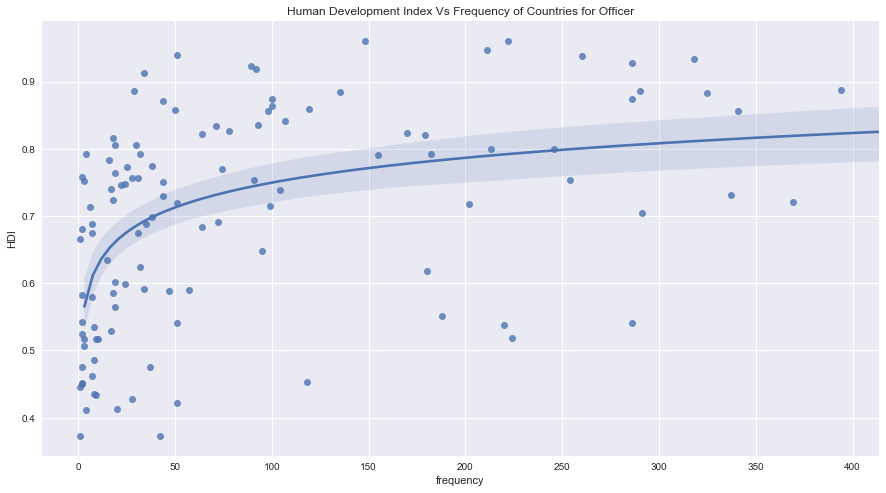

The last index is the human development index and there is a logarithmic correlation with the Panama entries, officers and intermediaries of around 0.4207873006904997 and p-value 2.8349214305321715e-06.

This means that the countries which are more developed appears more often in the papers. This result comes as a surprise, in the sense that we were expecting the less developed countries to be more cited.

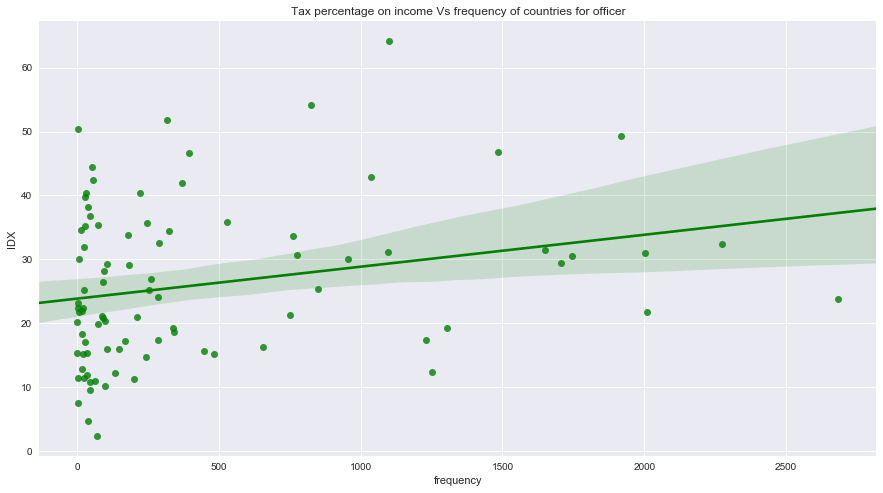

Finally we decided to check correlation with arguably the main reason behind transfering funds and properties to the fiscal paradise, namely the percentage of taxes on income.

As expected we found a correlation, however it is smaller than what we tought with a correlation value of 0.2490335967272295 and p-value of 0.018604013880805865 between the tax percentage and the frequency of officers countries.

Officers in countries with high taxes tend slightly more to evade taxes and put their money in fiscal paradises, but there are a multiplicity of factors to take into account, for examples bad governments have a higher chance of seizing properties and possessions.

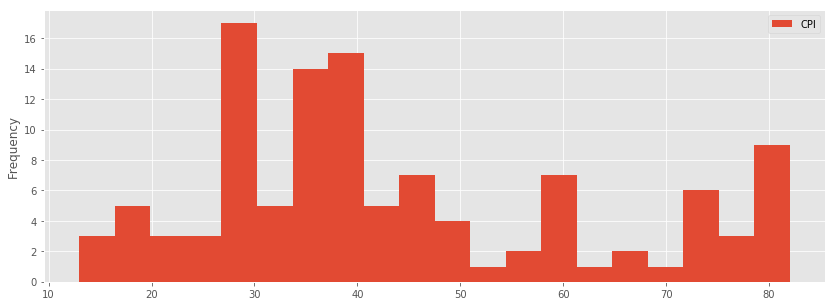

Last but not least, from the following plot we can see that there are power players coming from almost all bins with a corruption index ranging from 0 to 100. Although we can notice that most of of the power players come from CPI indexes ranging from 25-50.

Graph Analysis

Graph Analysis on Panama and Paradise Papers

Both datasets are comprised of similar structure as explained in the introduction. Thus, we can do a graph analysis on both of them with almost the same methods.

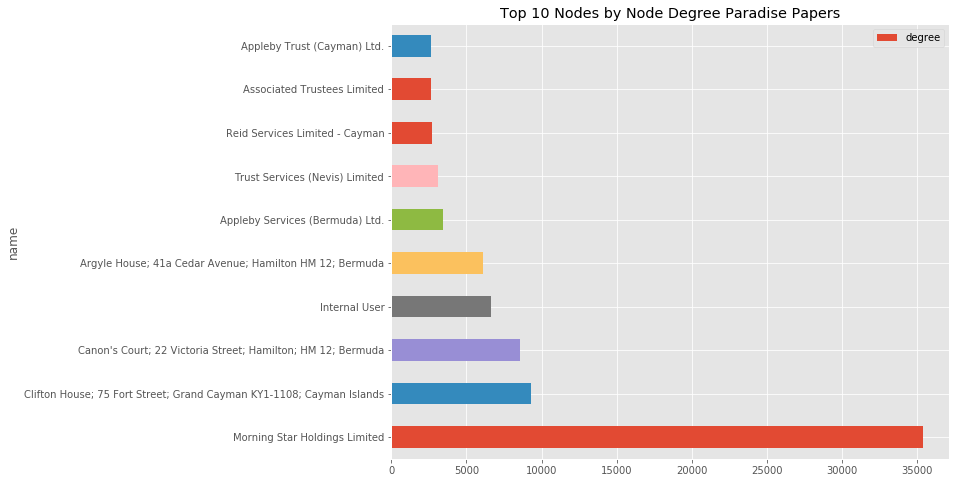

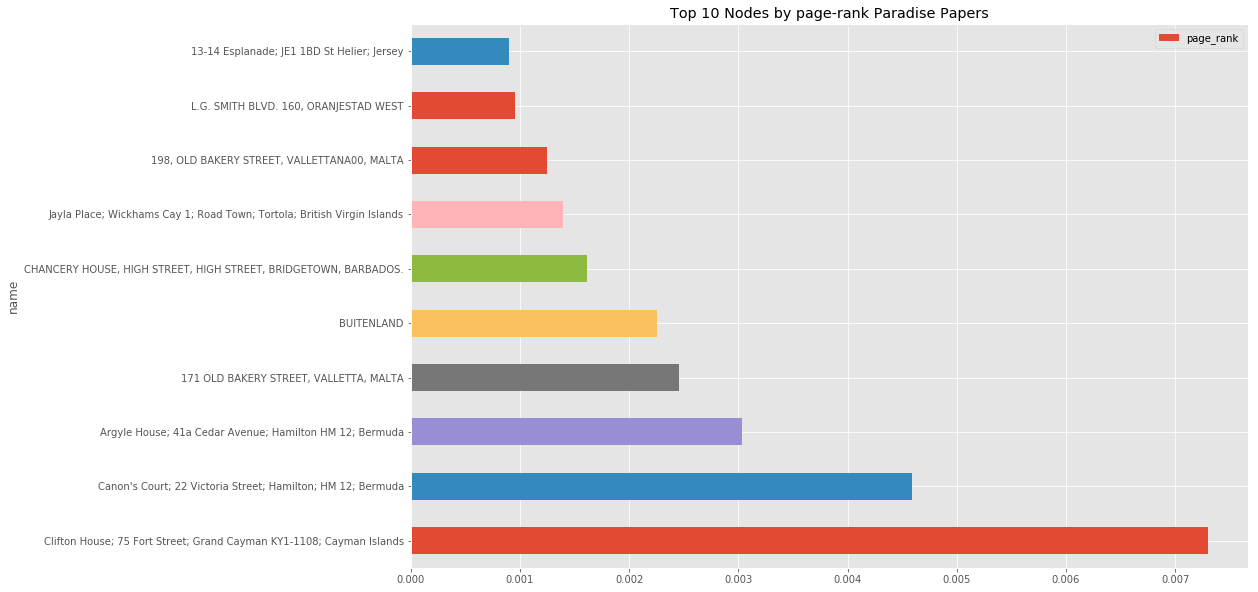

From the graph analysis, we discovered that the highest page-rank nodes are mostly addresses. This is actually quite logical as an address serves as a contact postal address, thus a lot of intermediaries which help clients to set up an offshore company, can not change the address and most of the times same addresses are being used. Therefore a lot of entities get linked to a similar address one way or the other.

Another interesting thing that was noticed, is the fact that the top 10 with the highest degree are mostly intermediaries. As mentioned in the introduction intermediaries serve as a middleman that helps a client to set up an offshore entity, therefore we can easily correlate why would they rank on top 10 of the highest degree nodes. Most of the intermediaries are based outside onshire jurisdictions and sometimes they are subject to different laws, thus making it very difficult to influence them, especially the big banks and trust companies.